Understanding Joint Annuities: A Simple Guide

Key Highlights

- Joint annuities are designed to provide annuity payments to two individuals and continue payments for the surviving spouse after one passes away.

- These insurance products are commonly used to secure steady retirement income for couples or partners.

- Payment structures can vary, including monthly payments, lump sums, or reduced payouts for the survivor.

- Survivor annuities offer financial support for the lifetime of the surviving participant.

- As part of an insurance product, joint annuities are backed by insurance companies and tailored based on life expectancies and contributions.

- They can be an excellent option for securing income in retirement while planning for longevity risks.

Introduction

Planning for stable income when you retire needs you to make a lot of choices, and joint annuities can be one of them. With these financial tools, you and another person both get annuity payments for all your lives. If one of you passes away, the other will still get the retirement income. This can bring peace of mind. Many couples or families pick joint annuities because they want to have a safety net that lasts as long as they do. The payments to you can be set up in different ways, and there are survivor benefits, too. All this makes joint annuities a good choice for those who want to keep their money safe for the long term.

Let’s take a look at how joint annuities work, what features they offer, and what you should think about before choosing one.

What Are Joint Annuities?

A joint annuity is an insurance product that gives regular payments to two people, usually a married couple or partners. An insurance company runs this plan and keeps paying the annuity as long as at least one of the annuitants is still alive. With a single-life annuity, you get payments that stop once the main person passes away. But a joint annuity gives you and your partner or spouse more good financial cover, as long as one of you is here.

A joint annuity is an insurance product that gives regular payments to two people, usually a married couple or partners. An insurance company runs this plan and keeps paying the annuity as long as at least one of the annuitants is still alive. With a single-life annuity, you get payments that stop once the main person passes away. But a joint annuity gives you and your partner or spouse more good financial cover, as long as one of you is here.

This type of annuity is helpful when you do retirement planning. Your payments are based on things like how much money you and the other annuitant have put in, and the life expectancy of both annuitants. With a joint annuity, both of you can know there will be money to help out later in life.

Key Features of Joint Annuities

Joint annuities have some clear features that make them good for long-term financial planning:

- Survivor annuity: If the first person in the couple dies, payments keep going to the surviving spouse.

- Primary annuitant: This is the person whose life expectancy is used to figure out how payments work.

- You can choose different payout options, like getting the whole payment, choosing a smaller survivor benefit, or getting one big lump sum.

These annuities let you pick how you want to get your money. For example, the annuity payments each month can stay the same or drop by a set amount if the primary annuitant dies. The insurance company decides the rules by looking at things like life expectancy and the money put in.

Choosing survivor benefits means the surviving spouse will still get money if the other person dies. But, make sure to look at all costs, like fees and commissions, so you can make the best choice.

Types of Joint Annuities Commonly Offered in the U.S.

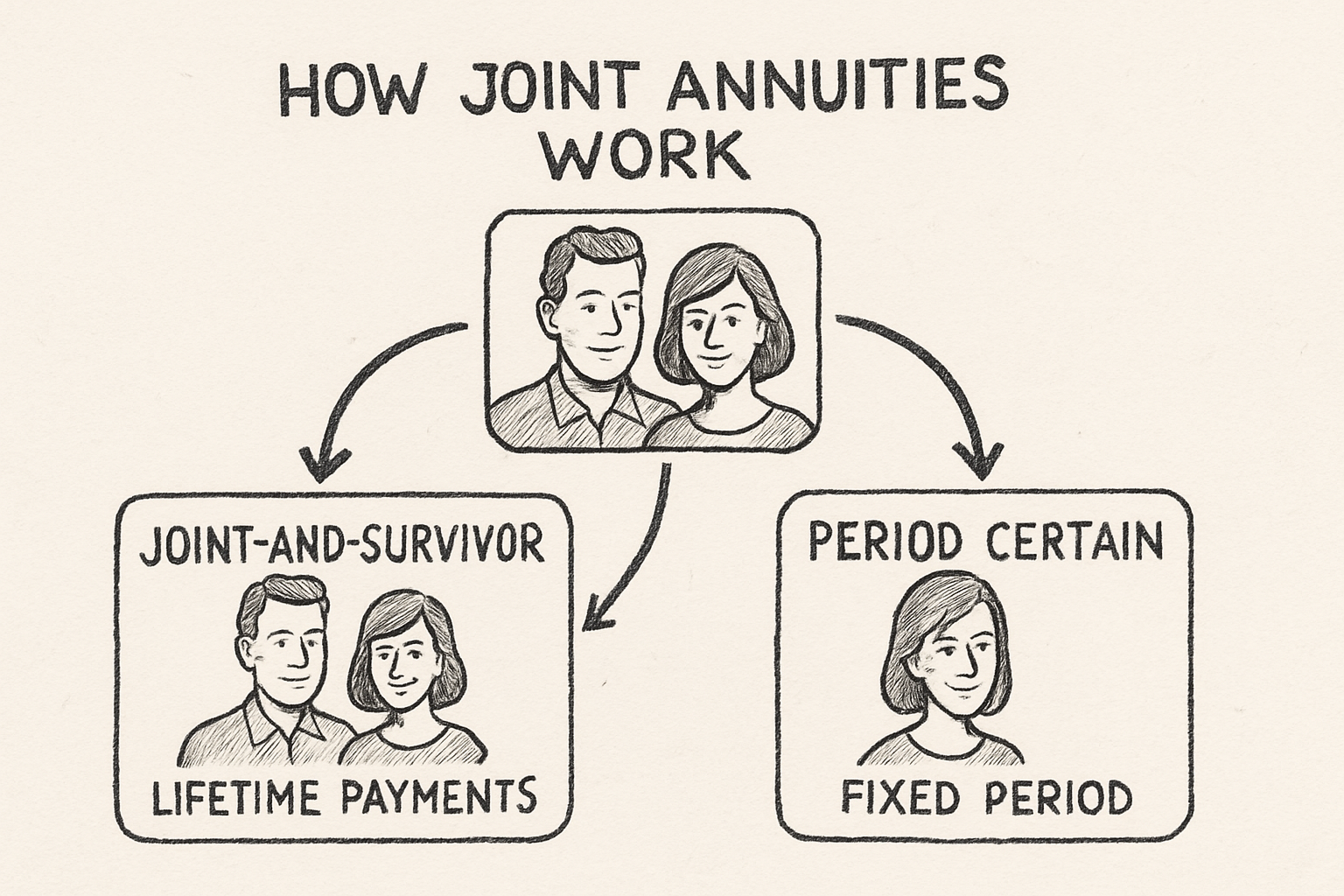

Different types of annuities are made to fit the needs and goals that people have with their money. Here’s a look:

| Type of Annuity | Features |

|---|---|

| Life Annuity | This gives payments as long as both annuitants are alive. The payments stop once both of them have died. |

| 2/3 or 1/2 Survivor Annuity | The monthly payments to the one who is still alive become smaller, by about 33% or 50% of what they used to be, after the other dies. |

| 100 Percent Survivor Annuity | After one annuitant dies, the other still gets the same full payment every month, with no cut in amount. |

| Lump-Sum Payout Annuity | When the first annuitant dies, the owner of the annuity gets all of the money in a single payout. |

These types of annuities, including survivor annuity and life annuity options, are often offered by insurance companies. They let people handle changes in life expectancy and help to make sure there be retirement income even when things change. With these choices, each type of annuity can give support with monthly payments, either for a whole lifetime or as a lump payout.

How Joint Annuities Work

Joint annuities work by giving regular payments to two people you choose. The amount you get depends on the money put in and the life expectancy of both people.

Joint annuities work by giving regular payments to two people you choose. The amount you get depends on the money put in and the life expectancy of both people.

When the primary annuitant dies, the surviving spouse will keep getting these payments. Some plans keep the same payment, while others might change the amount a bit. This kind of annuity helps make sure that both people always have an income, which is good for your retirement security.

Payment Structures and Payout Options

Joint annuities have different payout options to fit what you need.

- Monthly payments: You get money on a set schedule. It can stay the same or go up with inflation.

- Lump sums: You can take all the money at once. That gives fast access to your funds.

- Reduced payments like the original payment amount cut down to 67% or 50% if one person passes away.

This payment flexibility lets couples focus on their main money goals. For example, full survivor benefits keep giving monthly payments, while smaller survivor payments can let you get more cash now. The lump-sum option is good if you want your money right away, but you lose out on steady income.

To pick the best payout type, look at things like life expectancy, how much you have to invest, and if you want money now or during your whole life.

Tax Implications for Joint Annuities

Joint annuities come with different tax rules set by the IRS:

- If you use pre-tax money, like the money in an IRA, to pay for the annuity, you will not pay taxes right away. Taxes start once you get your payments. All payments get taxed as normal income.

- If you use money that you have already paid taxes on, you only pay taxes on the amount the annuity earned or grew by, not on the main amount you put in.

If you name someone as a beneficiary, they should think about the taxes over the long run. Taking money out carefully from different retirement accounts can help lower tax penalties. Having more than one income source, like an annuity, helps you better control your money and taxes after you retire.

Knowing the tax rules on an annuity, IRA, or from the IRS helps you stay on track with your goals for retirement.

Comparing Joint Annuities to Other Annuity Options

Unlike other types of annuities, joint annuities give financial safety to two people. Single-life annuities stop annuity payments when the person who owns the annuity dies. Joint annuities, however, let the surviving spouse keep getting benefits. Sometimes these benefits may be less, but they still help a lot after one person is gone.

For couples who want steady retirement income, joint annuities can cover both people as they get older. Still, you need to know that upfront fees for these options may be higher than for single-life plans. This difference in cost might affect if a joint annuity is the right pick for your retirement strategy.

Joint vs. Single Life Annuities

Choosing between joint annuities and single life annuities comes down to what you want and need.

| Comparison | Joint Annuities | Single Life Annuities |

|---|---|---|

| Payments | Pays money for both annuitants. | Payments will end when the annuitant dies. |

| Survivor Benefits | Give survivor a lower payment after death. | Can have a set time for payments even if the person is gone. |

| Life Expectancy Consideration | Takes the life of both annuitants into account. | Looks at only one individual and their life expectancy. |

Joint annuities are made to help a surviving spouse if one passes away. Single life annuities are better if you want a simple plan for yourself.

Joint Annuities vs. Other Multi-Life Annuities

Multi-life annuities give you flexible ways to set up your payments.

With multi-life annuities, the benefits can go to more than just one person who is still alive. These annuities usually cover more than one related annuitant. But joint annuities only give monthly payments to two people and change the payment if one passes away.

If you want more flexibility in coverage and monthly payments, you have choices between these options for retirement. For couples who want to make sure the money stays between just the two, joint annuities could be the best way to go.

Pros and Cons of Choosing a Joint Annuity

A joint annuity is an insurance product that helps give retirement income to two people. It makes sure the surviving person keeps getting money even after one person dies. This income would usually stop if only one person was named.

But, the money paid into this annuity can be higher than other options. If the annuitants die early, they might not get all the money that was put in. Other things might be better when you have bigger risks. Pick this insurance product if steady payments for a survivor match what you will need in your retirement years.

Benefits of Joint Annuities for Couples and Families

Key advantages for couples include:

- Making sure that payments go to a surviving spouse can lower the money worries after one partner is gone.

- Getting steady annuity payments can help cover everyday costs for all of your life.

- Having a simple plan for retirement income can make it easier for a family to plan ahead.

Couples who want to feel secure can get regular checks that consider how long they might live. Paying benefits to survivors can help families avoid money trouble when they lose someone. Receiving payments over the years goes well with savings that are protected by insurance.

Potential Drawbacks and Considerations

Despite being useful, joint annuities have some limits:

- You will get lower payouts than single-life options, which might not be good for those who want more money up front.

- If you or your partner dies early, you might not get the full value because of the fees and complex commissions.

- Unlike life insurance policies, annuities are not very flexible.

It is good to think about these potential drawbacks before you buy one. This helps you know about the costs and what you get in the long run.

Conclusion

In the end, knowing about joint annuities can really help people and couples who want to have money set aside together. Joint annuities give some special benefits for those who want the same money goals, but there are things you have to think about before you choose one. If you take the time to understand how joint annuities work, what payments you get, and what the tax rules are, you can decide what is best for you. If you want to see how a joint annuity could work for you, you can book a free talk with our team today!

Frequently Asked Questions

Who should consider a joint annuity?

People who want to keep getting annuity payments for their partner can look at joint annuities. This is a good option for anyone getting close to their 60s. It can help make sure there is retirement income for family members or a spouse. An annuity like this keeps looking out for both you and the people who count on you.

What happens to the payments if one annuitant passes away?

With a survivor annuity, the surviving spouse will get monthly payments. This can be the same as the original payment amount or be less, based on the plan. If the payments are less, the amount is changed to about 50% to 67% of the original payment amount.

Can I add or remove a beneficiary from a joint annuity?

As the owner of an annuity, you can remove or add a beneficiary, but it depends on the rules set by the insurance company. Fixed plans usually do not let you make many changes to this. Look at other types of annuities if you want more options and flexibility with your annuity.

Are joint annuities protected from creditors in the United States?

Sometimes, joint annuities are safe from people who want to collect money you owe. The IRS says this is true for many plans with retirement accounts. But, it is important to check the rules for each insurance product to make sure.

How do I choose the right joint annuity for my needs?

Choose a type of annuity that fits your life expectancy, the annuity payments you need, and the insurance company you trust. Make sure to balance your money goals, like how often you want to get paid and how long you need the payments to last. Also, compare different survivor options to find what works best for you.